About six students gathered in Vincent Hannerty’s dorm room in Canyon Point Tuesday night to watch President Barack Obama speak at the University of Colorado about keeping higher education financially accessible.

Hannerty, a third-year anthropology student who signed up for his first student loan this year, said he wanted to watch Obama’s speech because of the subject matter.

He took out the bare minimum ““ $5,000 ““ to avoid building up extra debt in the form of interest, he said.

Obama visited universities in swing states throughout this week to speak to students about his plan for higher education. He reiterated his commitment for keeping the current interest rate from doubling and making higher education more affordable.

“The key point here is, is that in America, higher education can’t be a luxury. It’s an economic imperative that every family has got to be able to afford,” Obama said in a conference call to college journalists on Tuesday.

Passed during former President George W. Bush’s term, the College Cost Reduction and Access Act of 2007 lowered interest rates on subsidized student loans, which are protected by the federal government, to 3.4 percent. The Act is set to expire July 1, five years after it was enacted, causing interest rates to revert back to 6.8 percent.

If Congress is unable to pass an extension on the 2007 law by July 1, interest rates for the loans will automatically double, affecting nearly 7.4 million student borrowers nationwide, according to an estimate from the Obama administration.

Democrats favor a bill that would end unwarranted tax breaks for Big Oil to keep the interest rates on student loans from doubling.

Republican House Speaker John Boehner, on the other hand, introduced a bill Wednesday that would cut funding from the Affordable Care Act to offset the government’s expenses for the lower interest rates. Both measures, however, would sustain the interest rate for only one year.

The House is expected to vote on Boehner’s bill today.

Like Hannerty, college students and university administrators around the country are watching closely as lawmakers attempt to beat the buzzer.

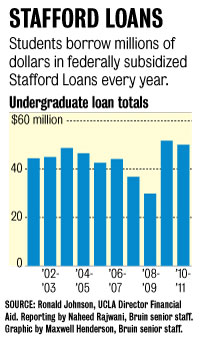

Nearly 15,000 UCLA students received the subsidized Stafford Loan in 2011 ““ a total expenditure of about $82 million, said Ronald Johnson, director of UCLA financial aid.

Because the issue falls in an election year, Johnson said he anticipates lawmakers will act swiftly in an attempt to appeal to young voters.

The debate surrounding interest rates for student loans exemplifies an “inter-generational problem,” said Edward Leamer, director of the UCLA Anderson Forecast and a professor of economics and statistics.

“The health care act is about taking care of the elderly, while loans for students are about creating a workforce for the future,” he said. “Those are two very different generations with different interests being pitted against each other.”

Hannerty said he plans to attend graduate school to buy some time before he has to start paying back his student loans.

“The moment I stop (school), I (will be) obligated to start paying the loans back and I don’t want to do that,” he said.

To avoid unnecessary debt regardless of whether rates rise, students should be looking at how they can cut their costs, such as switching to a lower meal plan, changing their residence package, or taking on another roommate if they live off campus, Johnson said.

Students should also only accept as many loans as they need, he added.

Contributing reports by Emily Suh, Bruin contributor.