UCLA students said they need to work long hours to cover high costs of living and other school-related expenses.

A study conducted in September by HSBC, a banking and financial services company, found students in the United States are spending more time working paid jobs than studying or going to class.

The survey also found the U.S. has the largest funding gap between parents and students across the surveyed countries, with college students spending six times more money than their parents on their education over the course of their college years.

The study found parents have had to reduce spending and more students have had to work paid jobs to afford college.

Paul Mullins, the regional head of international banking at HSBC, said in an email statement that researchers found 85 percent of current U.S. college students work paid jobs, with 37 percent of students looking for jobs to improve chances for employment after college. However, 57 percent of students said they work simply because they need the extra income.

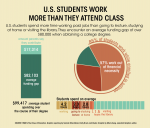

The study also found students spend about 4.2 hours a day working on average, compared to 2.3 hours a day in class, 2.8 hours studying at home and 1.5 hours visiting the library.

Mullins added in the statement that parents’ misjudgment of the cost of higher education is a major factor in students’ need to work paid jobs. The survey reported 62 percent of parents are forced to reduce nonessential spending to afford college education.

Patricia Gandara, a research professor of education at UCLA, said she thinks students feel compelled to work more hours because of increasing tuition and costs of living. Gandara added students may feel more obligated to work due to insufficient financial aid.

“Students are having to bear a whole lot more financial responsibility than they’ve had to in the past,” Gandara said.

However, Gandara said working does not always negatively interfere with students’ schoolwork. She added studies have shown that working about 15 hours a week can actually benefit students, especially if the student’s work is related to what they are studying.

“I think it helps them to organize their time better and helps them to focus,” Gandara said.

However, working upwards of 15 hours a week can become harmful to students’ academics, Gandara said.

“Once you get much over 15 hours a week, then it starts being really detrimental, and it really slows people down and gets in the way of studies,” Gandara said.

Emma Torres, a fourth-year history student, said she works at Kerckhoff Coffee House about 15 hours a week and sometimes up to 47 hours in two weeks. Torres added working so many hours interferes with her studies because she has less time to study.

She added working tires her out more and causes her to put off studying when she gets home.

Torres said the number of hours she works in a week depends on how much money she needs. She added she works many hours to afford textbooks, groceries and a reasonable standard of living.

“I find that when I need a little more money, I put off studying,” Torres said.

Hanna Almalssi, a third-year political science student who works for Associated Students UCLA Events Services, said she only works about nine hours a week, which does not interfere with her studies.

“If I worked more, it would definitely be interfering,” Almalssi said.

Almalssi said she knows many people who need to work long hours to cover rent, adding she thinks she is lucky to not have to worry about working to make ends meet.

“A lot of people are independent, so they do have to work a lot of hours,” Almalssi said.

Gandara said she thinks students are working long hours to avoid building up debt in college, but working too much can interfere with their studies. She added more financial aid should be provided for low-income students so they do not have to sacrifice their academics to work long hours.

“I think we need to be able to ensure that if students are willing to work hard and study, that they should not have to either graduate with huge debt or work too many hours, which could get in the way of their studies,” Gandara said.

If you can’t afford to go to college, then don’t. You’re likely to end up in debt to the extent that your earning potential simply makes you break even. Go to technical school, start your own business, or build experience without a degree. College is overrated for anyone who wants a career that doesn’t require a degree. If you have to ask yourself whether the job you want or the job you have actually requires a degree, then it doesn’t.