The United States felt its first major economic expansion in more than a year last quarter as gross domestic product grew by 3.5 percent, a growth that many believe signifies the end of the recession.

The growth in GDP, the measurement of domestic production, marks the official end to the recession as defined by the National Bureau of Economic Research, the institution responsible for determining the start and end of a recession.

But while the figure embodies the first positive gain in the U.S. economy since four straight quarters of losses, UCLA economists warn that the positive number will not cure the economy of hardships.

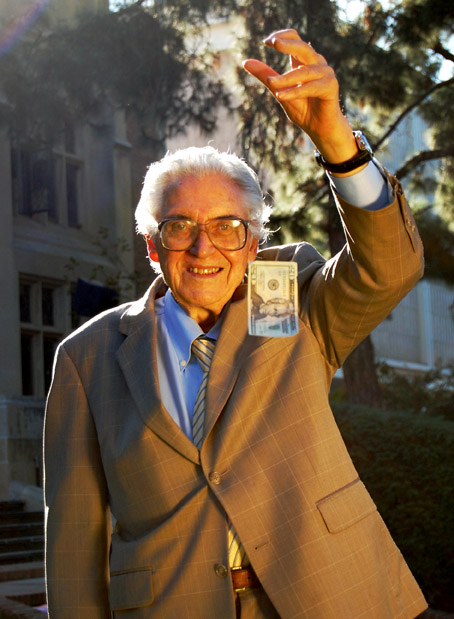

“(The GDP number) doesn’t alter our view, which is, going forward, that the economy is still going to be weaker than it might be otherwise,” said Edward Leamer, professor of economics and director of the UCLA Anderson Forecast.

UCLA economics Professor George Murphy, echoed the fear of continued economic hardship in spite of rising GDP.

“We are showing some signs of recovery, but we’re not yet out of the woods,” Murphy said. “We still have problems in our private sector.”

While domestic production slowly grows, the economic factors felt most by individual citizens are projected to persist on their receding path.

Both economists are wary of a continued rise in unemployment throughout the United States.

“We still have a lot of unemployment. That’s very typical,” Murphy said. “It takes some time to work all that unemployment out, and some economists have suggested that when you come out of a recession, people who became unemployed during the recession ““ they have a hard time ever getting another job.”

According to the United States Department of Labor, unemployment rose to a decade high rate of 9.8 percent in September.

“The labor market is terrible so we’re still getting massive layoffs, an increase in number of unemployed workers, and declining jobs,” Leamer said. “It’s likely to be a long stock, a kind of persistent level of high unemployment.”

Combined with this continuation of high unemployment, the nation’s future economic projection is disappointing.

Attributing much of the gains to onetime factors such as the stimulus package and the cash-for-clunkers initiative, UCLA economists are predicting less spectacular GDP growth in the future.

“We think it’s going to be in the 2 to 3 (percent) range, a disappointing range, not strong enough to turn that labor market around dramatically,” Leamer said.

“Normally at this time in the cycle, consumers are coming back and buying homes and cars and large hummers because interest rates are so low. This isn’t going to happen this time,” he added.