Future University of California employees could be able to choose from two retirement benefit options, according to a proposal released Friday by a UC task force.

UC President Janet Napolitano appointed a UC-wide task force of faculty, staff and administrators last year to determine a new set of retirement benefits. According to the proposal, UC employees hired after July 1, 2016 can choose between a hybrid defined benefit plan and a defined contribution plan.

In a defined contribution plan, the employer, employee or both make contributions to the retirement fund on a regular basis. In a defined benefit pension plan, an employer or sponsor promises a specified monthly amount based on the employee’s earning history, service and age.

The proposal outlines that the hybrid defined benefit plan will cap income available for pension payments, or pensionable income, at $117,020, compared to the existing cap of $265,000. This will mirror the 2013 California Public Employees’ Pension Reform Act, or PEPRA, cap proposed in 2013.

Employees who opt for the hybrid defined benefit plan will also receive a fixed supplemental contribution for income up to $265,000 which is the Internal Revenue Code limit. The pensionable income for defined contribution plan will also be capped at $265,000.

The budget deal negotiated between Napolitano and Gov. Jerry Brown last May called for Napolitano to create a task force that proposes a lower pension tier. In return, the state promised $436 million over a three-year period to help reduce the UC’s long-term pension debt of $7.8 billion.

Shane White, member of the task force and professor at the UCLA School of Dentistry, said it was difficult to work within the constraints of the PEPRA cap and the defined contribution plan when drafting the proposal.

White said he thinks the introduction of a defined contribution plan is not only less generous for the employee, but also is a less efficient use of the employer’s money. He added he thinks the supplement added on top of the reduced benefit plan is not enough money to compensate for the reduction in the proposal’s pensionable income cap.

Dan Pellissier, president of California Pension Reform, a political organization dedicated to solving California’s pension crisis, said he thinks the proposal shows the UC’s attempt to solve a problem that started almost 20 years ago.

Pellissier said he thinks the proposal is a step in the positive direction, but will be inadequate in solving the UC’s pension problem. He added he thinks the plan is too generous and should only be offered to top faculty members.

“This seems to be a plan driven by politics instead of financial stability,” Pellissier said.

Some members of the faculty said they were concerned the lower cap will significantly reduce the total compensation offered to employees.

Stanon Glantz, president of the Council of UC Faculty Association said he thinks UC faculty are already poorly compensated. He added he thinks the plan will make it much harder to attract and retain faculty, especially given the high cost of living in most parts of California.

Dan Hare, chair of the UC Academic Senate said he thinks the proposal make jobs in the UC system uncompetitive, compared to those at similar institutions.

“If salaries don’t increase to compensate for these reduced benefits, then the UC will have to settle for a lower-quality faculty members who did not receive better offers elsewhere,” Hare said.

In 2014, the total remuneration offered to a UC employee was 10 percent less than what is offered to faculty at other universities, according to a report presented to the Committee on Compensation at last July’s UC Regents meeting.

“Benefits used to make up for our uncompetitive salaries,” Hare said. “But this will no longer be the case.”

James Vernon, a history professor at UC Berkeley and board member of the UC Berkeley Faculty Association, said he thinks the task force had a difficult job.

“The task force was given a mission impossible,” Vernon said. “ They had to come up with a competitive plan while seeking to save UC money with a lower employer contribution.”

Vernon added he thinks the state’s funding offer of $436 million will not make up for the loss of the academic quality of the UC.

Glantz added he thinks the proposal compromises the UC’s contribution to the economy because the new generation of workers and leaders won’t receive the same quality of education.

White said he thinks there will be widespread dismay at the erosion of benefits for all employees. He added the administration has asked the UC Academic Senate to perform an expedited review and share their thoughts on the proposal.

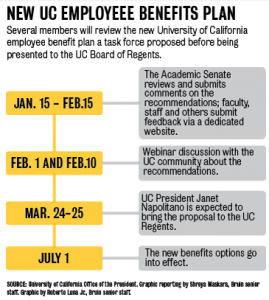

Napolitano announced members of faculty and staff can submit feedback to the proposal online.

Members of the UC community will discuss the proposal for the next two months. Napolitano is expected to bring a proposal to the Board of Regents meeting on March 23-24.

Contributing reports by Janae Yip and Ryan Leou, Bruin contributors.

Where’s the NO pension, no lifetime lotto millionaire salary option?

Step 1: Switch everyone to Defined Contribution.

Step 2: Give them all raises to maintain competitive salaries withe the private sector.

Step 3: Profit and have money to reduce tuition/class sizes, and increase improvements and maintain infrastructure.

Otherwise:

https://d2dv7hze646xr.cloudfront.net/wp-content/uploads/2016/01/01_pension_report1.png

pensiontsunami.com

“White said he thinks the introduction of a defined contribution plan is not only less generous for the employee, but also is a less efficient use of the employer’s money. He added he thinks the supplement added on top of the reduced benefit plan is not enough money to compensate for the reduction in the proposal’s pensionable income cap.”

people do not care about doing a good job. they only care about their salary and pension. its amazing how thats all these public union people talk about.