As college students rack up a record amount of debt, the federal government in recent months has been trying to ease the burden for students by increasing the accessibility of an income-based repayment plan.

Although some students found the plan to be positive, many said they are simply not aware of the plan.

Out of 15 million borrowers of federal student loans who have continued to repay their loans as of June 2013, only about 10 percent of them have chosen any kind of income-based repayment plan, according to a report by the Consumer Financial Protection Bureau in August.

The most recently established income-based plan, Pay As You Earn, caps monthly payments at 10 percent of a borrower’s discretionary income. While it is different from other plans that cap payments at 15 or 20 percent of one’s discretionary income, only 40,000 graduated students are enrolled in Pay As You Earn as of June 2013.

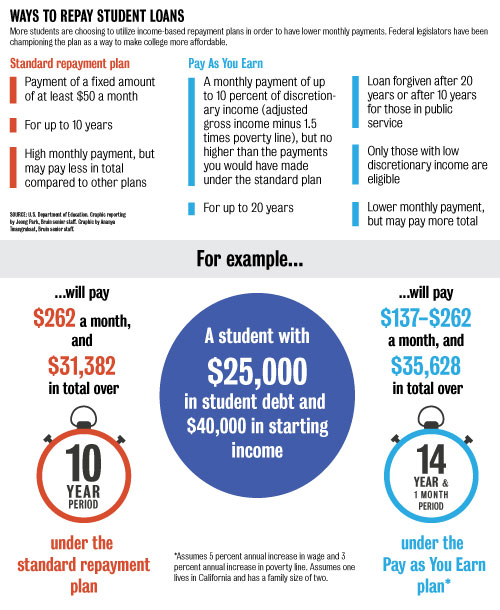

Under the standard repayment plan, a student pays a set amount every month for 10 years.

Although there have been other plans that base one’s payment on income, federal lawmakers have championed Pay As You Earn plan for its low payment cap.

President Barack Obama recently expanded the plan, which was previously only available to borrowers who took out their first loan after October 2007 and continued to take out loans after October 2011, to cover up to five million borrowers who do not fall under the category.

Under the Pay As You Earn plan, students may pay less every month, which works best for those receiving a low or moderate salary once they graduate, said Nancy Coolidge, associate director of student financial support for the University of California.

Coolidge said individuals with higher incomes would not see much of a difference, as they would likely pay off a similar amount every month as they would have paid under the standard repayment plan.

Coolidge said a lower monthly payment under the Pay As You Earn plan does come with a catch, as students may end up making payments for a longer period of time and accumulating more interest on their loans.

However, debt is forgiven under the plan after 20 years, or 10 years if one is employed in a government or nonprofit job, so some students may end up not having to pay a sizable portion of their debt, Coolidge said.

Coolidge said each campus in the UC has tried to educate students about new income repayment plans by tutoring them about managing debt: UCLA does so when students first take out a loan and when students graduate.

Despite the university’s efforts to make the plan more widely known, many students said they are unaware or have not thought about how to repay their loans.

Olivia Jurkiewicz, a fourth-year psychobiology student, said she has not really considered how to pay back her loans, as she is planning to go to a graduate school or medical school.

She said she has not heard about the Pay As You Earn plan, but she would have to consider various aspects of her financial situation, such as her income once she graduates, before choosing a way to repay her loan.

“If (my) parents (tell) me I’m cut off from them or my job doesn’t pay well, (an) income-based plan would work,” Jurkiewicz said. “But the plan would be a last resort.”

Matthew Cook, a fourth-year philosophy student, said he wasn’t aware of the newest repayment plan. Cook, who said he plans to go to a law school, said he would prefer a standard repayment plan because he wants to pay back the loan as fast as possible to take the weight off of his shoulders.

Students’ lack of knowledge about these income-based repayment programs has not stopped the federal government from trying to enroll more students in the plan.

The Senate introduced a bill in mid-July to reform the way students pay their debt. One of the proposals in the bill, called the Dynamic Student Loan Repayment Act, would establish just one income-based repayment plan for student loans and collect the money directly from graduates’ paychecks once they graduate and start paying back their loans.

Coolidge said the federal government has been encouraging students to enroll in the income-based repayment plan because it will give the government more revenue in the long run.

“The federal government is making money off of those who repay,” Coolidge said. “It’s (to the) federal government’s advantage to allow people to stretch out their payment.”