The issue of student debt can often be overshadowed by the more prominent discussion of rising tuition levels.

For many students, accrued loans have no immediate, tangible impact. And until we start making our post-graduation payments, the world of debt, interest, default and repayments is easier to put off for four years than to try and understand now.

Though tuition increases may seem to be the more imminent problem, it is vital that students be proactive in understanding the implications of taking on thousands of dollars in debt when signing on to student loans.

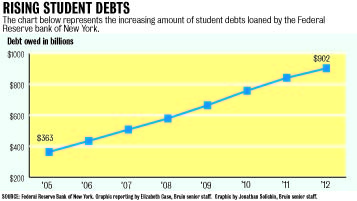

With student debt topping $1 trillion nationally and a 13.4 percent default rate among U.S. graduates who first began making payments in the 2009 fiscal year, student loans may be the next big bubble to burst.

Such uneasiness with loans is a concern shared by members of Strike Debt, an offshoot of the Occupy Wall Street movement, who gathered in lower Manhattan mid-November in order to raise money to buy and forgive debt at random.

Strike Debt acts as a benevolent collection agency, finding debt that has been heavily discounted by lenders and sold for pennies to the dollar. But unlike what happens with most debt collectors, once this debt is bought, it is immediately forgiven.

The overall effort of the group has so far accrued over $400,000 to “abolish” more than $8 million in all sorts of debt. Unfortunately, little, if any, of this money can go toward student debt, which is indicative of a larger problem.

Ninety percent of student loans are disbursed by the federal government and are not sold on the open market like credit card, medical and private student loan debts. Debt created by these student loans is out of reach from groups like Strike Debt.

While an increase in federal loans has made education more accessible, this same increase has led to greater total student debt.

As the job market falters and unemployment remains high, encouraging everyone to attend college creates a dangerous cycle in which loans are given easily, regardless of a student’s predicted ability to repay, ignoring indicators like choice of major, grades or the particular institution the student attends.

Because the majority of student loans come from federal coffers, groups like Strike Debt can only play an advisory role in the education sector, providing free manuals for combating student debt and encouraging the creation of a community unafraid to identify themselves as debtors.

Similarly, students must take the initiative and educate themselves about loans and debts. After all, these issues will become sharply pertinent when indebted college graduates begin trying to buy a car or rent an apartment.

For example, it is important to know distinctions such as the following: Unlike a mortgage, there is no collateral for student loans. This means that student debt is rarely forgiven in bankruptcy court unless undue hardship for repayment is proven.

These lessons are often glossed over by guidance counselors, university administrators and politicians who still present “college” as the American dream.

The consequences of such a convoluted system?

Indefinite years of garnished wages, schools refusing to release transcripts, bad credit ratings, seizure of tax refunds and refusal to issue new loans.

But these outcomes are long term, and sometimes less visible as a result, which can place rising tuition in a more prominent light.

When this bubble bursts, and the hundreds of thousands of students who have taken on unreasonable amounts of debt are unable to pursue their American dream, I can only hope there will be others standing beside us like Strike Debt willing to bail us out.

Email Ugarte at rugarte@media.ucla.edu. Send general comments to opinion@media.ucla.edu or tweet us @DBOpinion.