California college students, on average, are graduating with less debt than students in most other states, according to a study released last week by the Institute for College Access & Success, an Oakland-based nonprofit organization that conducts research on higher education topics.

Based on student debt data voluntarily reported by colleges from 2011 ““ including UCLA ““ the institute found debt levels for college students vary significantly from state to state, said Debbie Cochrane, research director and co-author of the Project on Student Debt, an initiative of the institute.

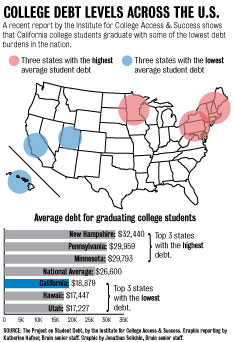

The report ranked California as having the third lowest rates of debt for college graduates in the United States, trailing Hawaii and Utah.

While the national average for the amount of college debt with which students graduate is $26,600, the average at UCLA is $18,814, said Ronald Johnson, director of financial aid at UCLA.

At UCLA, 30 percent of students in 2011 were Pell Grant ““ or federal financial aid ““ recipients, Cochrane said.

The states with the highest rates of college student debt are New Hampshire, Pennsylvania and Minnesota, according to the report.

The report includes data from public and nonprofit private universities.

Though not all institutions contributed their individual statistics, about 80 percent of national universities are represented, Cochrane said.

Sarah Treleaven, a fourth-year physiological science student, said she was surprised to find out California students have relatively low amounts of student debt upon graduation.

“I don’t like to think about (how much I’ll graduate with),” she added.

California has ranked favorably compared to other states for many years, Cochrane said.

“Historically the public need for college graduates drives the debt down in the state,” she said.

The Cal Grant system, or state financial aid program, may largely account for California’s lower levels of indebtedness, Johnson said.

“The level of support that is made available (by the state) has basically facilitated students to get their education here in California and minimized their indebtedness,” Johnson said.

Susana Peñaloza, a first-year physiological science student, is currently receiving financial aid from the Cal Grant program, she said.

She added that she expects to graduate about $20,000 in debt in a few years, greater than the average student debt in California.

The financial state of California public higher education is currently at an impasse, with much of its institutional funding resting on the passage of Proposition 30 in the Nov. 6 election.

The proposition ““ supported by Gov. Jerry Brown ““ would temporarily raise the state’s income and sales taxes.

If Californians vote down the measure, the UC and CSU will each receive trigger cuts of $250 million.

“Even though (the UC is) in an uncertain (financial) environment, California has a very robust financial aid system,” Johnson said. “If there is ever any threat to the (Cal Grant) program of being reduced, that’s why we should ardently fight for it.”

Cochrane said it is hard to predict whether or not possible tuition increases in the future would affect student debt rates.

“It’s not simply a question of rising tuition,” Cochrane said. “It’s a question of whether or not financial aid can keep pace.”

Contributing reports by Chris Hurley, Bruin contributor.