State lawmakers expect the recently enacted California budget to close a $15.7 billion state deficit through major cuts in government spending and increases in revenue contingent on tax increases ““ but officials say the budget is shrouded in uncertainties.

Signed into effect last week by Gov. Jerry Brown, the budget assumes the passage of Brown’s proposed tax increase, which would increase the sales tax by a quarter of a cent per dollar and raise taxes on households that make more than $250,000 annually. But the state will not know whether it will receive the expected $8.5 billion increase in revenue until November, when Californians take to the polls and vote on the measure.

For these reasons, the 2012-2013 enacted budget is not a done deal, said Steve Boilard, director of higher education at the Legislative Analyst’s Office.

“The overriding issue is uncertainty ““ for both the tax measure and projecting how much money taxes will even bring in,” Boilard said.

If the increase does not pass, the state’s K-12 and higher education systems would face further cuts as legislators work to close the state’s multibillion-dollar funding deficit. This would lead to a $250 million cut to the University of California and California State University systems, likely prompting a midyear double-digit tuition increase for students, officials said.

Despite the uncertainties surrounding the budget, Boilard said the analyst’s office acknowledges the necessity of using the tax measure to bring in extra revenue for the state.

“The magnitude of the budget problem means considering raising taxes as well as serious budget cuts,” he said. “It is unrealistic to close a $16 billion (deficit) just through cuts.”

Daniel Mitchell, a professor emeritus of the UCLA Luskin School of Public Affairs and the UCLA Anderson School of Management, said relying on Brown’s tax initiative may prove to be risky because polls suggest the increase currently only has about 50 percent support among voters.

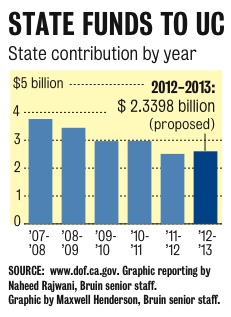

The 2012-2013 budget contains no changes in general funding to the UC for the upcoming academic year, but promises to fill a $125 million gap in funding for the UC and CSU ““ known as a buyout ““ in 2013-2014, contingent on both the passing of Brown’s tax increase and a tuition freeze for the university systems in the upcoming year.

The tuition freeze would mean not raising students’ tuition for the 2012-2013 academic year.

“The UC basically has two options,” said Paul Golaszewski, a UC specialist at the analyst’s office. “Increasing tuition and giving up state funding for 2013-2014, or waiting for November and having mid-year tuition increases if (the tax increase) fails.”

The UC Board of Regents will discuss whether to increase tuition at its bimonthly meeting in July.

In a statement released Thursday, UC President Mark Yudof said he plans to recommend to the regents that tuition not increase for the upcoming year, a move that seems risky but necessary to UC officials.

“There is some risk since (the tuition buyout) is dependent on the initiative passing, but it’s the best chance we have for keeping tuition stable for this year,” said Steve Montiel, a UC spokesman.

Mitchell said he anticipates that the budget will prove positive for UC students who pay their own tuition because it looks like there will be no immediate tuition increase in the upcoming year.

But the possible tuition buyout in 2013-2014 does not solve all of the UC’s funding issues, according to Montiel.

Regardless of the possible buyout, the budget leaves the UC with a $125 million gap in funding for 2012-2013.

The UC will have to come up with the $125 million in funding on its own, but university officials are not yet sure what they will do to close the gap.

“We will have to institute some extraordinary, one-time-only measures to balance our budget without a fee increase in the bridging year,” Yudof said in his statement.

While the budget does not change any general funding to the UC, the state did increase funding to the university system in the form of $90 million allocated for retirement and maintenance costs, marking the first state contribution to the UC Retirement Plan in more than 20 years.

A separate part of the budget changed eligibility requirements for Cal Grants, including higher overall graduation rates for schools and lower loan default rates. Brown also reduced the total reward amount for Cal Grants recipients at private colleges.

Changes to the Cal Grants program will not affect the UC, which already has high graduation rates, Montiel said.

The regents will meet in mid-July to settle financial decisions for the UC for the upcoming year.