When arriving on campus during move-in day, first-year students tend to bring a lot of stuff. Sheets, shampoo and covertly smuggled coffee makers are placed into giant, rolling bins and wheeled toward the elevators. But the vast majority of students bring along more than just the essentials ““ they also bring concerns about how they’re going to be able to pay for their education.

In fact, according to the National Center for Public Policy and Higher Education’s Great Expectations survey, of 1,015 people over the age of 18 surveyed, 80 percent “at least somewhat agree” that students have to borrow too much money in order to afford a college education.

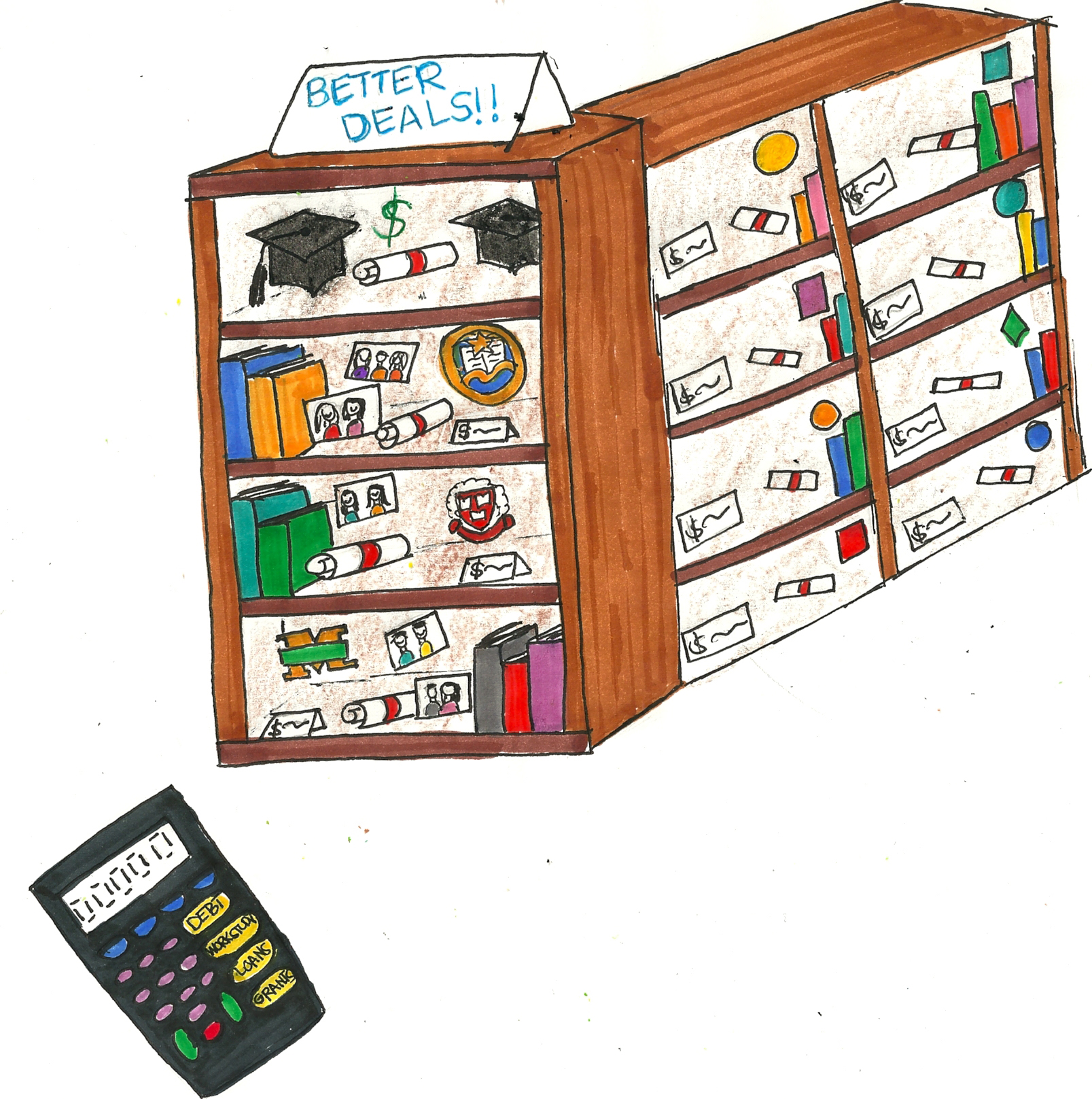

When Congress passed the 2008 Higher Education Opportunity Act, it mandated that all universities provide a means for applicants to calculate their educational costs while factoring in all forms of financial aid. Nationwide, universities have complied with this mandate by creating, as Congress termed them, “net price calculators.”

The mandated creation of these calculators is a huge and positive step forward in increasing university cost transparency. Although universities did not have to publish these calculators until October 2011, now students who attend or are applying to universities that provide these calculators have an easier way to determine the total cost of higher education with the inclusion of potential grants and scholarships.

In order to guarantee that these calculators are used to their full capacity, colleges themselves need to take the initiative and create cost calculators to inform students quickly and logically what an education will cost them and how much debt they will likely have post-graduation.

Luckily for students at UCLA, the University of California has one of the most straightforward calculators around. It requires only basic input information such as parental marital status and total income taxes paid. The “Paying for UC” page on the UC’s website provides links to identical calculators for each campus.

UCLA Financial Aid Office Director Ronald Johnson said the “financial aid estimator” on the UCLA Financial Aid Office’s website is intended mostly as a tool for prospective students.

“The purpose of the calculator is to give students a ballpark estimate of their financial aid eligibility,” Johnson said.

Unfortunately though, not all calculators are created equal. Many, such as the calculator used by the University of North Carolina, are exceedingly long and complicated. Some calculators require extensive quantities of personal information ““ information that students may not have readily available and is time-consuming to enter. Because of the volume of data required, such as sibling age and total mortgage costs, students may be discouraged from completing the cumbersome requirements.

While the existence of these calculators alone is an achievement, locating them is still a challenge. While some calculators provide a great deal of helpful information, many net price calculators do more to obscure costs with convoluted terminology than outline them for potential students.

Not every university refers to the calculators by the same name. The UCLA calculator is referred to as a “financial aid estimator.” Most students are unaware of this terminology, let alone that a tool like this actually exists. These calculators aren’t publicized, and from a school’s main home page, they’re almost impossible to find. While the UCLA calculator is available on the Financial Aid Office’s home page, unless students know what terminology to look for, they’re likely to gloss over it.

Anthony Trochez, a first-year doctoral student in education, said he had never heard of the calculators.

“They could do good,” Trochez said. “But how do you even quantify an education? How can you possibly have any really accurate way to tell an individual whether the investment will be worth it after graduation?”

While this uncertainty cannot be solved with a calculator, these price estimators can provide students with a rough idea of how much debt they’re going to have after graduation. To do so, however, they must be formatted in a clear manner to allow easy use by students unfamiliar with complicated financial calculations.

In a recent editorial, the New York Times recommended the federal government hold all calculators to the same standard: Every calculator should be simple, user-friendly and avoid personal questions such as name and religion.

But the sheer effort the government would be required to put forth in order to ensure every calculator was easy to use would hardly be cost effective. As it is, the federal government has done and continues to do its part in increasing cost transparency. In fact, the federal government is aggressively taking on the challenge of making financing a college education more comprehensive.

The Consumer Financial Protection Bureau and the Department of Education are developing a university “shopping sheet” to allow students to compare the costs of various colleges based on the type and amount of financial aid for which they qualify, and the Department of Education is working on a similar “college scorecard.”

UCLA needs to encourage the use of these calculators as a means of helping currently enrolled students get up-to-date information about their tuition costs. While the calculator is on the UCLA Financial Aid Office’s website, and the website is included with every piece of information the office sends to prospective students, the calculator itself is never advertised, let alone to current students. With tuition hikes becoming more and more frequent at public institutions, net price calculators allow current students to adjust their cost and debt estimates in accordance with fee changes.

The important thing to note is that the government is finally attempting to cultivate greater university cost transparency. But there is more to be done. While UCLA’s calculator is comprehensive, until every university makes the decision to develop easy-to-use calculators, students will still have to meet the challenge of obscured college costs.

Email Tashman at atashman@media.ucla.edu. Send general comments to opinion@media.ucla.edu or tweet us @DBOpinion.